Tax tips can help you with your tax planning and preparation needs. Consider using the free and helpful content that the IRS offers before your undertake to prepare your tax return. These updates are in plain English not in tax code legal jargon. The IRS just created more work for us, instead of tax updates residing in the app or in Google Reader, the IRS sends an email which has to be opened,saved or deleted..

They should ask Google about integrating some of their IRS instructions and publications into Google Reader while providing the taxpayer relevant content specific to the taxpayer's particular tax situation. I am sure Google would love that. Do you think it would be helpful if the IRS provided us with relevant tax content, that we might otherwise not use, and how much benefit Google would receive if they worked with the IRS for this purpose.

Another thought, should Google replace the current IRS email system with Gmail and then write code for Google Reader to integrate with IRS2Go. The IRS website says that privacy and security are paramount and there is brief privacy notice in the app. The IRS website says that your information will be masked and encrypted for security purpose.

If your smart phone is lost or stolen, will another person be able to see this tax return information, Using the IRS phone number does offer greater security protection if this risk is a concern to you. You will save time by using this free app rather than calling the IRS phone number to learn about your refund status.

Many online tax preparation services provide a web based service for your to prepare your tax return online and offer a free refund tracking service which enables you to monitor your IRS refund status from their website. 58,000 or less otherwise you will have to pay a fee to use an online tax preparation service, some of whom offer great deals. Don't forget to, e-file early and get that refund working for you now and start tracking your IRS refund.

3. In the “Signature” section, you need to add your signature text in the box. You have the option to format your message by adding an image or changing the text style. 4. Once you have created the signature, click Save Changes at the bottom of the page. That’s pretty much it! So, that’s how you can make your messages look more professional. Feel free to shoot it in the comments below.

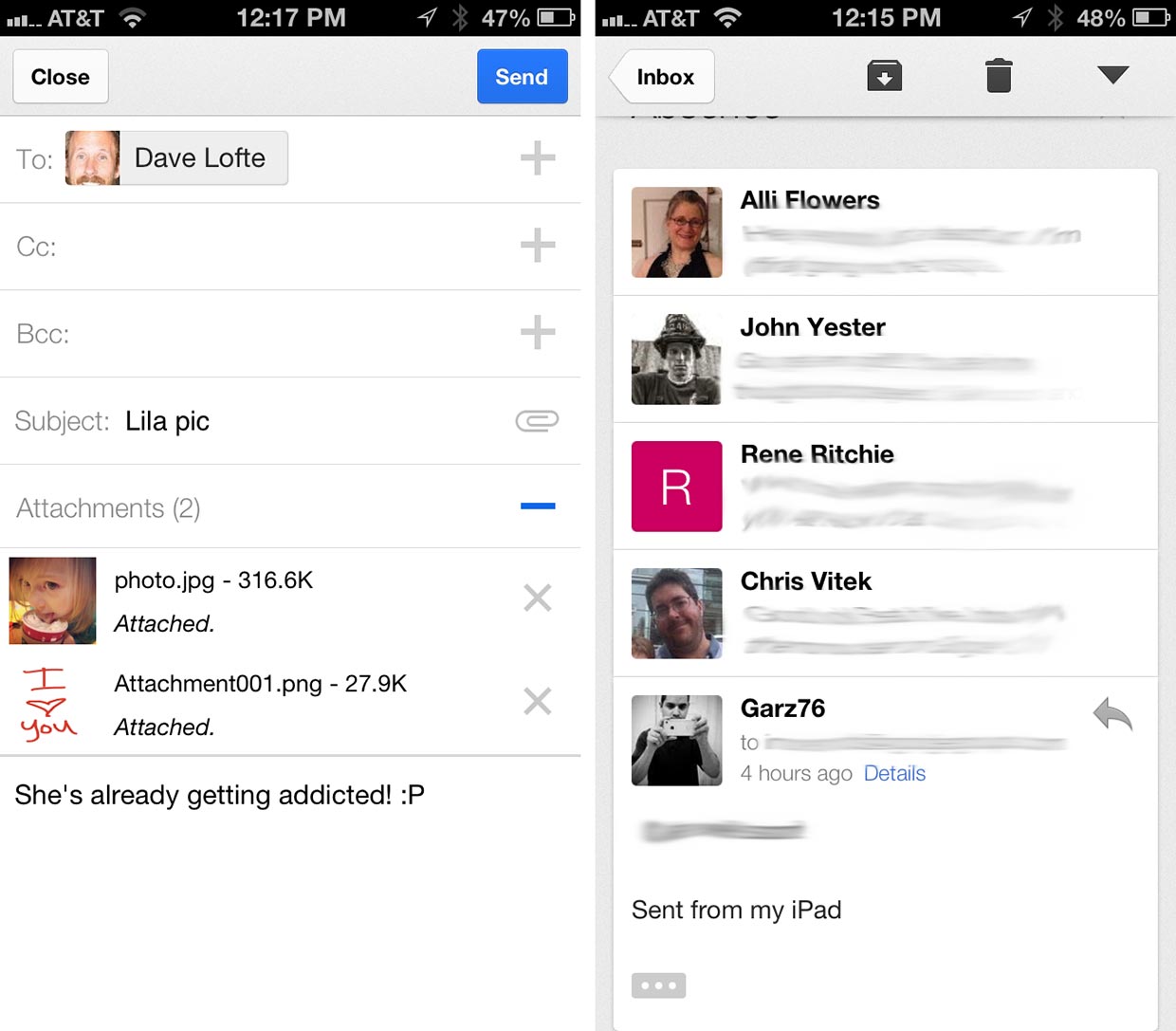

A few years ago, Google announced it was ending support for the Exchange ActiveSync Protocol (EAS) for most users. Now those of us who were grandfathered in have changed devices, and likely lost that grandfathered status. So how do you get Gmail pushed to your iOS device without having to download the Gmail app - or giving up the built-in mail client, It’s pretty simple - you resort to the only free email option that Apple provides push to - a secondary iCloud account. But what about that pesky “iCloud won’t let you send as another address” problem,

Simple fix - use GMail’s SMTP server. Receiving mail sent to your Gmail address in iOS’s built-in mail client with push speed (no Fetching!) & Sending mail with your Gmail address (or custom alias). This method will likely be somewhat annoying if you’re a heavy Gmail in the browser user, since most of your inbox will live in iCloud. This method works best if you use mail clients on your mobile devices and desktop, and rarely use webmail.

This method isn’t as nice if you have a Gmail account that you use to send out as another user (i.e. whatever@gmail.com but you usually send as whatever@customdomain.com). I explain this in more detail below, but it boils down to this: Your device won’t be able to tell Gmail what to send out as, so Gmail will assume you want to send as your primary address. If you’re a Google Apps Free user, then this method will work fine.

0 Comments